For quotes or additional information about MTA or township government, call (517) 321-6467 or email jenn@michigantownships.org.

MTA press release on House-passage of renewable energy siting bills

House-passed renewable energy siting bills do not protect local control Battle on behalf of true local voices over siting and permitting process shifts to state Senate. A coalition of organizations representing local governments, land use planning and the agriculture community continues to oppose the fast-moving legislative efforts overhauling siting and

We will continue to fight for local voices and local authority over renewable energy siting

The following statement is in response to committee passage of House Bills 5120-5123, which preempt local authority over utility-scale renewable energy facilities in Michigan communities. Please attribute the quote to MTA Executive Director Neil Sheridan. Many of the individuals, including township elected officials, planning commissioners and residents, who testified against

Poll: Residents believe local governments should have say in renewable energy facilities in their community

Poll: Residents believe local governments should have say in renewable energy facilities in their community Newly introduced bill would shift all siting and permitting from local governments to state Most Michigan residents believe that the state’s townships, cities and villages should have the final say on siting and permitting for

Michigan Townships Association awards its Robinson Scholarship to future local leaders

Delta Charter Township, MI – The Michigan Townships Association has awarded three individuals aspiring to careers in public service its 2023 Robert R. Robinson Memorial Scholarships. The annual award, available to a junior, senior or graduate student in a Michigan college or university, aims to encourage today’s students to seek

Don’t silence local voices to achieve renewable energy goals

The following is an MTA statement in response to Gov. Whitmer’s comments on Aug. 30 and pending legislation on moving renewable energy siting from local communities to the Michigan Public Service Commission. Utility-scale renewable energy siting can be an incredibly contentious topic in communities across the state. But the answer

Two Groveland Township leaders earn credentials in township governance

Two Groveland Township officials have taken the next steps to further enhance the effectiveness of their township by completing the Michigan Townships Association’s (MTA) Township Governance Academy (TGA). Through their participation in the intensive education program, Treasurer Theresa Bills and Deputy Clerk Jenell Keller were able to learn enhanced tools

Davison Township leader earns credential in township governance

Travis Howell, a long-time Davison Township (Genesee Co.) public servant currently serving on its zoning board of appeals, has taken the next step to further enhance the effectiveness of his township by completing the Michigan Townships Association’s (MTA) Township Governance Academy (TGA). Through his participation in the intensive education program,

Yates Township leader earns credential in township governance

Blair Evans, who serves Yates Township (Lake Co.) on its planning commission, zoning board of appeals and board of review, has taken the next step to further enhance the effectiveness of his township by completing the Michigan Townships Association’s (MTA) Township Governance Academy (TGA). Through his participation in the intensive

Cargill elected 2023 MTA first vice president

Cargill elected first vice president of Michigan Townships Association Golden Township (Oceana Co.) Treasurer Connie Cargill has been elected first vice president of the Michigan Townships Association (MTA). She was elected to the position helping to lead the state’s largest municipal association by her peers at MTA’s 2023 Annual Educational

Harmful legislation would silence local voices on sand and gravel mining

Harmful legislation would silence local voices on sand and gravel mining Bills go against public sentiments supporting local say in aggregate operations in Michigan communities Lansing, Mich.—Legislation newly introduced under the guise of solving aggregate supply chain issues will eliminate all local authority over sand and gravel mines and silence

Bill Deater is MTA’s 2023 immediate past president

Deater serves as Michigan Townships Association immediate past president Grant Township (St. Clair Co.) Supervisor Bill Deater will serve on the Michigan Townships Association (MTA) executive committee as the Association’s immediate past president, following his term as 2022 president. Serving more than 99% of Michigan’s 1,240 townships—which includes more than

Marvin Radtke Jr. named member-at-large on MTA Executive Committee

Marvin Radtke Jr. named member-at-large on Michigan Townships Association Executive Committee Green Lake Township (Grand Traverse Co.) Supervisor Marvin Radtke Jr. has been named member-at-large on the Michigan Townships Association’s (MTA) executive committee. The executive committee, and the entire board of directors, provides strategic and operational guidance to MTA, which

Malinda Cole-Crocker is 2023 MTA secretary

Cole-Crocker elected secretary of Michigan Townships Association Buchanan Charter Township (Berrien Co.) Supervisor Malinda Cole-Crocker has been elected secretary of the Michigan Townships Association. Cole-Crocker, who also serves at MTA District 22 director on the Association’s Board of Directors, was elected to the secretary position at MTA’s 2023 Annual Educational

Kevin Beeson elected 2023 MTA treasurer

Beeson elected treasurer of Michigan Townships Association Pine River Township (Gratiot Co.) Supervisor Kevin Beeson has been elected treasurer of the Michigan Townships Association (MTA). He was elected to the position helping to lead the state’s largest municipal association by his township peers at MTA’s 2023 Annual Educational Conference, held

Harold Koviak is MTA’s 2023 second vice president

Burt Township supervisor elected second vice president of Michigan Townships Association Burt Township (Cheboygan Co.) Supervisor Harold Koviak has been elected second vice president of the Michigan Townships Association (MTA). He was elected to the position at the Association’s Annual Educational Conference & Expo, held April 17-20 at the Grand

Cargill elected 2023 MTA first vice president

Golden Township (Oceana Co.) Treasurer Connie Cargill has been elected first vice president of the Michigan Townships Association (MTA). She was elected to the position helping to lead the state’s largest municipal association by her peers at MTA’s 2023 Annual Educational Conference, held April 17-20 at the Grand Traverse Resort

Bennett to lead Michigan Townships Association as 2023 president

Addison Township (Oakland Co.) Clerk Pauline Bennett has been elected president of the Michigan Townships Association (MTA). Serving more than 99% of Michigan’s 1,240 townships—which includes more than 6,500 elected leaders plus tens of thousands of additional township appointed officials, staff and volunteers—MTA is the largest municipal association in the

Welcome Ken Verkest to MTA Board as District 21 director

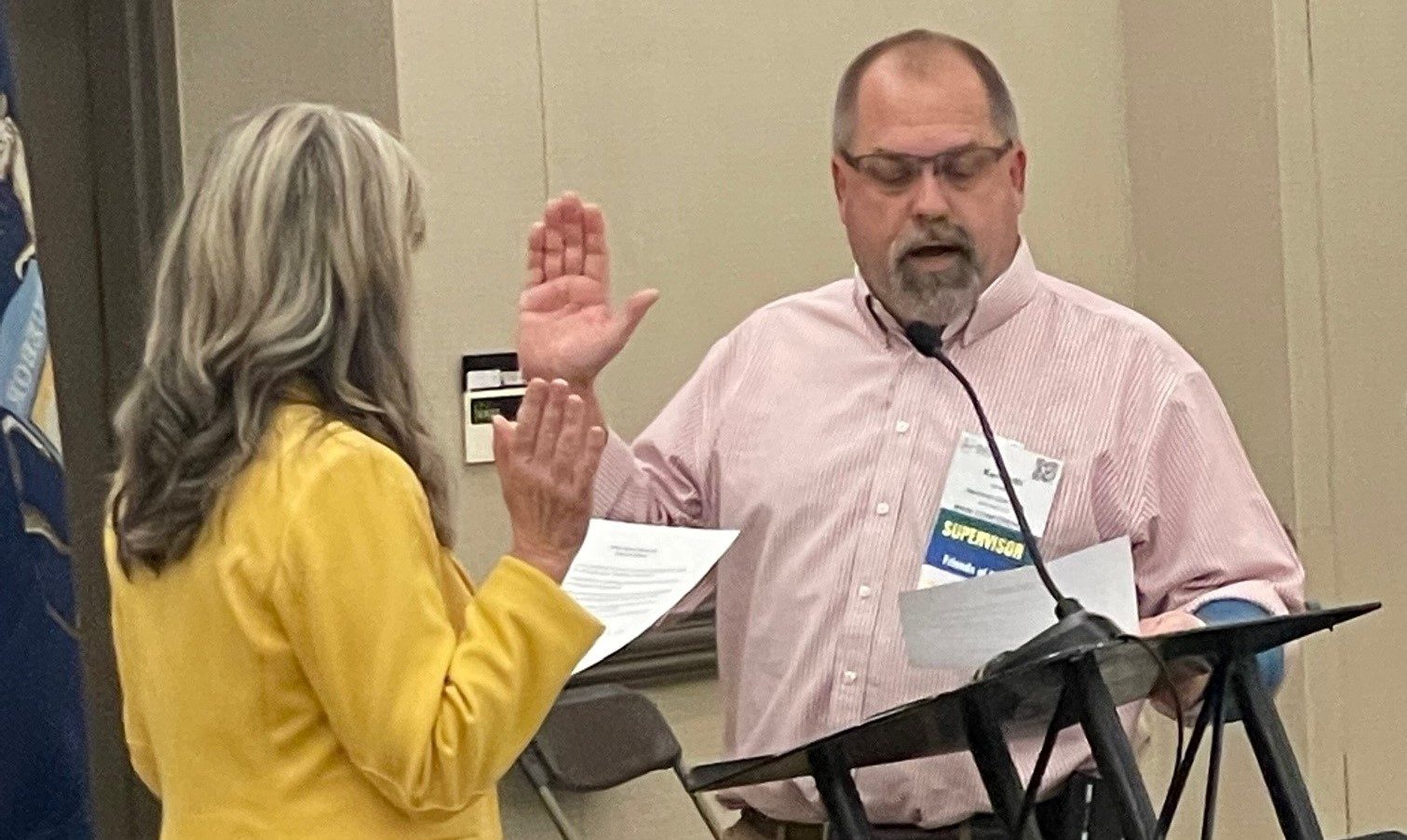

Verkest elected to MTA Board of Directors Harrison Charter Township (Macomb Co.) Supervisor Kenneth Verkest has been elected to the Michigan Townships Association (MTA) Board of Directors, serving as director of MTA District 21, which encompasses Lapeer, Oakland and Macomb Counties. Verkest was elected to the position by his township

MTA sets 2023-24 legislative priorities

Michigan Townships Association sets 2023-24 legislative priorities The Michigan Townships Association announces its 2023-24 legislative priorities, following adoption of its policy platform by Association member township officials. The MTA membership approved the Association’s platform on April 20 at the MTA Annual Meeting, held in conjunction with the MTA Annual Conference

Michigan Townships Association announces new Executive Committee

Pauline Bennett, clerk of Addison Township (Oakland Co.), has been elected 2023 MTA president. Bennett was elected president of the largest municipal association in Michigan at MTA’s Annual Educational Conference & Expo, held April 17-20 at the Grand Traverse Resort in Acme Township. Bennett has served as clerk since 1996,

MTA offers scholarship to students pursuing a career in local government

Applications are now being accepted for an annual scholarship that provides financial assistance to today’s students who are aspiring to future leadership roles in Michigan communities. The deadline for the MTA Robert R. Robinson Scholarship is May 31, 2023. The scholarship is designed to help Michigan students who are preparing

Revenue Sharing Trust Fund would provide financial stability to townships

A two-bill package to support Michigan’s cities, villages, townships and counties that was introduced in the Legislature will go a long way to providing much needed financial stability for local governments. Senate Bills 182 and 183 sponsored by Senator Mike Webber (R-Rochester Hills) and Senator Jeremy Moss (D-Southfield) respectively, and

More than 200 township leaders convene for MTA’s 2023 Capital Conference

On March 1, township officials from across the state convened in Lansing today for the Michigan Townships Association’s (MTA) 2023 Capital Conference to gather insights and information on key township issues at the forefront in Lansing, including the need for investments in local communities, preservation of local control and modernizing

MTA: Proposed budget recognizes need to support townships and other local governments

Please attribute the following statement to Neil Sheridan, executive director of the Michigan Townships Association (MTA), in response to today’s executive budget proposal by Gov. Whitmer: Safe communities, safe drinking water and essential local services are all critical to the success of Michigan’s townships. We are encouraged that the governor’s

Statewide Leaders Demand Action on Electric Vehicle Road Funding Shortage in Michigan

Action needed immediately to avoid half-billion dollar funding gap for transportation County road agencies; governmental and industry stakeholders call for pilot project to move toward fair funding solutions LANSING – Today leaders from the newly-formed Coalition on Electric Vehicles and Transportation Revenue held a news conference steps from the Capitol

Read full Proposal 2022-2 “Protect the Vote” language

The process to implement changes because of the passage of Proposal 2022-2 has begun. This will require updates to election procedures, some of which are required for 2023 elections and some for elections in 2024 and beyond. The state Bureau of Elections will be conducting a Lean Process Improvement (LPI),

MTA: Updated solid waste laws protect local government authority, provide essential tools

The following statement should be attributed to Michigan Townships Association (MTA) Executive Director Neil Sheridan: The Michigan Townships Association appreciates the Legislature’s leadership in protecting local authority on the long-needed statutory action modernizing Michigan’s solid waste laws, which passed in this year’s final day of legislative session. MTA is among

Flushing Charter Township clerk earns credential in township governance

Flushing Charter Township (Genesee Co.) Clerk Wendy Meinburg has taken the next step to further enhance the effectiveness of her township by completing the Michigan Townships Association’s (MTA) Township Governance Academy (TGA). Through her participation in the intensive education program, Meinburg was able to learn enhanced tools and decision-making processes

Ironwood Charter Township Clerk Re-elected to Michigan Townships Association Board of Directors

Mary Segalin, Ironwood Charter Township (Gogebic Co.) clerk, has been re-elected to her role as District 1 director on the Michigan Townships Association (MTA) Board of Directors. District 1 encompasses Gogebic, Houghton, Keweenaw and Ontonagon Counties. Segalin was re-elected to the position by her township peers at the Association’s Annual Conference,

Cole-Crocker named member-at-large on Michigan Townships Association Executive Committee

Buchanan Township (Berrien Co.) Supervisor Malinda Cole-Crocker has been named member at-large on the Michigan Townships Association (MTA) Executive Committee. The Executive Committee, and the entire Board of Directors, provides strategic and operational guidance to MTA, which serves more than 99% of Michigan’s townships and is the state’s largest municipal organization.

Cargill elected second vice president of Michigan Townships Association

Golden Township (Oceana Co.) Treasurer Connie Cargill has been elected second vice president of the Michigan Townships Association (MTA). She was elected to the position helping to lead the state’s largest municipal association by her peers at MTA’s 2022 Annual Educational Conference, held April 25-28 in Lansing. Cargill, who has

Bret Padgett re-elected to Michigan Townships Association Board of Directors

Comstock Charter Township (Kalamazoo Co.) Treasurer Bret Padgett has been re-elected as District 19 director on the Michigan Townships Association Board of Directors. Padgett was elected to the position by his township peers at MTA’s 2022 Annual Educational Conference, held April 25-28 in Lansing. As director of MTA District 19,

Boon Township supervisor elected to Michigan Townships Association Board of Directors

Matthew Beattie, Boon Township (Wexford Co.) supervisor, has been elected to the Michigan Townships Association Board of Directors, serving as director of MTA 9 District, which encompasses Clare, Missaukee, Oscoda and Wexford Counties. Beattie was elected to the position by his township peers at the Association’s Annual Conference in April.

Burt Township supervisor elected treasurer of Michigan Townships Association

Burt Township (Cheboygan Co.) Supervisor Harold Koviak has been elected treasurer of the Michigan Townships Association (MTA). He was elected to the position at the Association’s Annual Educational Conference & Expo, held April 25-28 in Lansing. Koviak, who has served as township supervisor since 2002, was first elected to the MTA

Kleiman named immediate past president of Michigan Townships Association

Harris Township (Menominee Co.) Supervisor Peter Kleiman has been named immediate past president of the Michigan Townships Association (MTA). Kleiman, who was 2021 MTA president, has been township supervisor since 1988 and has served on the MTA Board of Directors since 2011. “I am honored to continue in a leadership

Deater elected 2022 president of Michigan Townships Association

Grant Township (St. Clair Co.) Supervisor Bill Deater has been elected 2022 president of the Michigan Townships Association (MTA). Serving more than 99% of Michigan’s 1,240 townships—which includes more than 6,500 elected leaders plus tens of thousands of additional township appointed officials, staff and volunteers—MTA is the largest municipal association

Sharon Schultz re-elected to Michigan Townships Association Board of Directors

Torch Lake Township (Antrim Co.) Treasurer Sharon Schultz has been re-elected to her role on the Michigan Townships Association (MTA) Board of Directors. Schultz, who first joined the MTA Board in 2017, will continue to serve as director of MTA District 6, which encompasses Antrim, Crawford, Kalkaska and Otsego Counties,

Schafer re-elected to Michigan Townships Association Board of Directors

Eagle Township (Clinton Co.) Supervisor Patti Jo Schafer will continue to serve the Michigan Townships Association (MTA) Board of Directors, after being re-elected District 20 director at the Association’s Annual Educational Conference & Expo, held April 25-28 in Lansing. Schafer was re-elected by her township peers at a caucus election to

Rowley Elected to Michigan Townships Association Board of Directors

Bangor Charter Township (Bay Co.) Supervisor Glenn Rowley will continue to serve on the Michigan Townships Association (MTA) Board of Directors, following his election as director of MTA District 13—which encompasses Bay, Gladwin and Midland Counties—at MTA’s 2022 Annual Educational Conference, held April 25-28 in Lansing. Rowley was first appointed

Raisin Charter Township supervisor elected to Michigan Townships Association Board of Directors

Tom Hawkins, Raisin Charter Township (Lenawee Co.) supervisor, will continue to serve the Michigan Townships Association (MTA) on its Board of Directors, following his election as director of MTA District 24—which encompasses Hillsdale, Jackson and Lenawee Counties—at MTA’s 2022 Annual Educational Conference, held April 25-28 in Lansing. Hawkins was first

Newton Township treasurer re-elected to Michigan Townships Association Board of Directors

Newton Township (Mackinac Co.) Treasurer Marilyn Stickland will continue to represent township officials in Chippewa, Luce, Mackinac and Schoolcraft Counties as District 4 director on the Michigan Townships Association (MTA) Board of Directors. Strickland was re-elected to the position by her township peers at a caucus election held during the

Nankervis re-elected to Michigan Townships Association Board of Directors

Ishpeming Township (Marquette Co.) Supervisor James Nankervis will continue to serve on the Michigan Townships Association (MTA) Board of Directors, after being re-elected MTA District 2 director in a caucus election during the MTA Annual Conference & Expo, held April 25-28 in Lansing. District 2 encompasses Baraga, Dickinson, Marquette and

Morton Township trustee re-elected to MTA Board of Directors

Morton Township (Mecosta Co.) Trustee Yulanda Bellingar will continue to serve as District 12 director, which encompasses Isabella, Mecosta and Newaygo Counties, on the Michigan Townships Association (MTA) Board of Directors. Bellingar was re-elected to the position by her township peers at a caucus election held during the Association’s Annual

Marvin Radtke Jr. re-elected to Michigan Townships Association Board of Directors

Green Lake Township (Grand Traverse Co.) Supervisor Marvin Radtke Jr. will continue to serve the Michigan Townships Association (MTA) Board of Directors, after being re-elected director of MTA District 8, which includes Benzie, Grand Traverse, Leelanau and Manistee Counties. Radtke was re-elected to the position by his township peers at

Lewandowski elected to Michigan Townships Association Board of Directors

Robert Lewandowski, Port Huron Charter Township (St. Clair Co.) supervisor, has been elected to the Michigan Townships Association Board of Directors, serving as director of MTA 18 District, which encompasses Sanilac and St. Clair Counties. Lewandowski, who was elected to the position by his township peers at the Association’s Annual

Lake Township trustee elected to Michigan Townships Association Board of Directors

Lake Township (Menominee Co.) Trustee Warren Suchovsky will continue to help guide the state’s largest municipal association—the Michigan Townships Association (MTA)—on its board of directors, after being re-elected to serve as the MTA District 3 director. Suchovsky was re-elected to the position at MTA’s 2022 Annual Educational Conference, held April

Kimberly Anderson re-elected to Michigan Townships Association Board of Directors

Whitney Township (Arenac Co.) Clerk Kimberly Anderson will continue to serve on the Michigan Townships Association (MTA) Board of Directors, after being re-elected to serve as director of MTA District 10, which includes Arenac, Iosco, Ogemaw and Roscommon Counties. Anderson was re-elected to the position by her township peers at

Kenneth Lobert elected to Michigan Townships Association Board of Directors

Ossineke Township (Alpena Co.) Supervisor Kenneth Lobert will continue to help guide the state’s largest municipal association—the Michigan Townships Association (MTA)—on its board of directors, after being re-elected to serve as the MTA District 7 director. Lobert was re-elected to the position at MTA’s 2022 Annual Educational Conference, held April

Rogers re-elected to MTA Board of Directors

Coldwater Township (Branch Co.) Supervisor Donald Rogers will continue to serve on the Michigan Townships Association (MTA) Board of Directors, after being re-elected to the position of MTA District 23 director at the Association’s Annual Educational Conference & Expo, held April 25-28 in Lansing. Rogers has served as director of District

James Township treasurer re-elected to MTA Board of Directors

James Township (Saginaw Co.) Treasurer Joanne Boehler will continue to represent District 17, which encompasses Genesee, Saginaw and Shiawassee Counties, on the Michigan Townships Association (MTA) Board of Directors. Boehler was re-elected to the position by her township peers at a caucus election held during the Association’s Annual Educational Conference